Net Unrealized Appreciation for Company Stock in an Employer-Sponsored Retirement Plan

Written by: Jeff Campos, Wealth Manager Here at Wheelhouse, we guide many families nearing retirement who work for companies that allow employees to purchase company stock within their employer-sponsored retirement plans. This offers employees the opportunity to invest in their company and the ability to let those assets grow (or ...

Read More Non-Spousal Inherited IRAs

Written by: Garrett Bohler, Wealth Manager Here at Wheelhouse, we have had an influx of families with non-spousal inherited IRAs. A non-spousal inherited IRA is an IRA that was inherited from someone else other than your spouse. When you have a new account type there are often corresponding questions about ...

Read More Claiming Social Security Benefits

Written by: Jacob Brydels, Wealth Manager Are you approaching retirement and thinking about when to claim your Social Security benefits? Social Security decisions are personal, and we are here to help you navigate the options to determine what's best for you. To qualify for Social Security, you must have paid ...

Read More Senior Property Tax Freezes

Written by: Garrett Bohler, Wealth Manager As we are now a few months into 2025 and the senior citizen property tax freezes in our area are coming up for renewal or some of you are applying for your first time, we wanted to share some important reminders. We have been ...

Read More The US Debt Ceiling

Written by: Jeff Campos, Wealth Manager The debt ceiling has been around since World War 1, it was established to keep our federal government’s spending in check so that our nation doesn’t run out of money. The debt ceiling has been raised multiple times over the years, which allows the ...

Read More The Wheelhouse Way – Our Annual Client Review Process

Written By: Anthony Striker, MBA – Senior Wealth Manger As we enter 2025, I wanted to share with you what the annual review process looks like at Wheelhouse from an internal perspective. Each year, Wheelhouse client families have reviews with their Wheelhouse Wealth Manager that often range from 1-2 hours ...

Read More 2025 IRS Contribution Limits

Written by: Lauren Ferraro, CFP ®, CPC, CPFA, AIF®, Senior Wealth Manager On November 1, the IRS announced the contribution limits for 2025, and unless it is extended, the Tax Cuts and Jobs Act is set to sunset at the end of 2025. With this information, the text below pertains ...

Read More Understanding the COLA and its Impact on Social Security Recipients

Written By: Garrett Bohler - Wealth Manager As we leave October behind us, we now know how much of a cost-of-living adjustment (COLA) Social Security recipients are going to receive in 2025. The Social Security Administration announced that based on the CPI-W they would be giving an adjustment of 2.5% ...

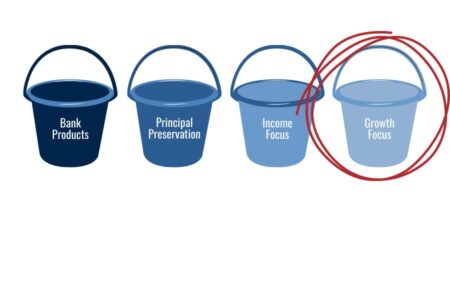

Read More Managing Risk in your Growth Bucket

Written by: Andrew Briesacher – Wealth Manager The Stock Market can certainly be a difficult place to navigate. At Wheelhouse, we believe that all investments can have their place as long as you understand the differing risk and potential returns that specific investments entail. When considering investments in the growth ...

Read More Retirement Planning During the Accumulation Phase

Written By: Anthony Striker, MBA - Senior Wealth Manger Here at Wheelhouse, we specialize in helping families get “to and through retirement” as comfortably as possible. For that reason, we usually work with families and individuals who are within 5 years of retirement or are already retired. However, we also ...

Read More 529 Plans

Written by: Lauren Ferraro, CFP ®, CPC, CPFA, AIF®, Senior Wealth Manager A common concern for parents and grandparents is saving for education expenses given that the cost of college continues to rise each year. One way to save for these expenses is through a 529 plan. A 529 plan ...

Read More The Basics of How the Stock Market Works

Written by: Andrew Briesacher – Wealth Manager Many times we get asked by prospects and clients “how does the stock market work?”, the simple answer is that the stock market is a complex auction system where shares of publicly traded companies are bought and sold. For this article, we will ...

Read More Prepaid Funeral Arrangements

Written by: Lauren Ferraro, CFP ®, CPC, CPFA, AIF®, Senior Wealth Manager In recent years, prepaid funeral arrangements have become popular. While end-of-life decisions are often a difficult conversation to discuss with loved ones, setting aside money for these types of expenses so that your loved ones do not have ...

Read More Election Year Insights

Written by: Anthony Striker, MBA - Senior Wealth Manager You may have heard, it’s an election year! One of the most common questions Wheelhouse advisors get during election years is “What can we expect from the stock market during an election year?” In our opinion, it is important to remember ...

Read More Fraud Prevention

Written by: Lauren Ferraro, CFP ®, CPC, CPFA, AIF®, Senior Wealth Manager Fraud occurs when someone wrongfully attempts to steal money or personal information to result in financial gain. There are different types of fraud including phishing scams, data breaches, identity theft, credit fraud, and mail fraud. To prevent fraud ...

Read More Investor Bias

Written by: Andrew Briesacher - Wealth Manager Bias comes into play with any decision made in life. It should come as no surprise that our biases can often affect our emotions when making decisions about money. Even as a wealth manager, I too am no stranger to letting past experiences ...

Read More Health Savings Accounts

Written By: Rishi Ghosh - Founder and Principal What better time to talk about Health Savings Accounts than the season that is riddled with falls, viruses, and colds? A Health Savings Account or “HSA” is a tax-advantaged savings account available to people who are enrolled in a High Deductible Health ...

Read More The Wide World of Annuities

Written By Anthony Striker, MBA - Senior Wealth Manager Today I want to put in writing some thoughts that I have about what I jokingly tell our clients is the “most googled term in our industry”, annuities. Like any other product, annuities can be used as a tool in a ...

Read More Changes to Social Security for 2024

Written by Lauren Ferraro, CFP®, CPC, CPFA, AIF® - Senior Wealth Manager Whether you’re sitting around the dining room table, playing golf with friends, in the office, or at the gym, It often seems as though the word “retirement” cannot be mentioned or discussed without “Social Security” joining the conversation ...

Read More Retiring With A Mortgage

Written by: Andrew Briesacher, CRPC® - Wealth Manager Recently, many clients and prospects have inquired about whether they should pay off their mortgage in retirement. While there can be easy math behind the decision, there are a lot of factors to consider before finding the best course of action. The ...

Read More The Importance of Knowing Your Fees

Written by: Anthony Striker, MBA - Senior Wealth Manager This month I want to talk all about fees and account or investment costs. When working with a financial advisor, or even when self-managing an account, it is imperative to know what costs are associated with that account, investment, or overall ...

Read More <strong><u>FDIC, SIPC, and State Guaranty Funds</u></strong>

Written by: Lauren Ferraro CFP ®, CPC, CPFA, AIF®, Senior Wealth Manager The collapse of Silicon Valley Bank and Signature Bank earlier this year has caused customers and investors to reassess whether their assets are protected in their bank accounts, brokerage accounts, and insurance companies. There are separate types of coverage ...

Read More Buffered ETFs – Worth the Hype?

Written by: Andrew Briesacher, CRPC® – Wealth Manager Here at Wheelhouse Advisory Group, we aren’t a team that jumps on a new trend without thorough research and investment discipline; however, we do think it is important to stay on top of new ideas and products so that we fully understand ...

Read More Planning for Vacations and One-off Expenses

Written by: Andrew Briesacher, CRPC® – Wealth Manager With summer vacations in full swing, now is a perfect time talk about planning for these types of expenditures in retirement. It is important to discuss how you plan financially for expenditures like vacations or one-off expenses in retirement. Many times, when ...

Read More Recessions – Is there one in our future?

Written by: Anthony Striker, MBA, Senior Wealth Manager What You Should Know About Recessions With inflation being higher than average and interest rates rising, you may have heard talk or seen headlines about an upcoming recession. This month, we wanted to detail what a recession is and how it can ...

Read More Caring for Aging Parents

Written by: Lauren Ferraro, CFP ®, CPC, CPFA, AIF®, Senior Wealth Manager Are your parents aging and or already experiencing difficulties managing and preparing their finances for their future, including a future where they may no longer be in control? Often times adult children find themselves in a situation where ...

Read More Planning for Loved Ones

Written by: Anthony Striker, MBA - Senior Wealth Manager When building our overall financial picture, we cannot forget those near and dear to us. This can include planning for our spouses, children, grandchildren, nieces and nephews, and many more! For this blog post I wanted to touch on life insurance, ...

Read More <strong>Here’s what you need to know about SECURE Act 2.0</strong>

Written by: Rishi Ghosh, Founder & Principal The first version of the SECURE Act, which passed in December 2019 had two main walkaways for retirees: It pushed Required Minimum Distribution (RMD) age back from 70.5 to 72 and It eliminated the “stretch IRA” for beneficiaries, now requiring Inherited IRAs to ...

Read More <strong>Gifting Strategies and Catch-up Contributions</strong>

Written by: Anthony Striker, MBA, Senior Wealth Manager As the year-end nears, this is a good time to consider the benefits of gifting. Gifting allows you to pass assets to beneficiaries in a tax-efficient manner. Giving assets to your loved ones while you are alive has many benefits. Gifting allows ...

Read More - Ready to Take -The Next Step?

For more information about any of our products and services, schedule a meeting today or register to attend a seminar.